Renters Insurance in and around Stow

Looking for renters insurance in Stow?

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

There’s No Place Like Home

No matter what you're considering as you rent a home - location, number of bathrooms, number of bedrooms, house or apartment - getting the right insurance can be crucial in the event of the unexpected.

Looking for renters insurance in Stow?

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

When the unanticipated break-in happens to your rented apartment or townhome, often it affects your personal belongings, such as a cooking set, a microwave or a stereo. That's where your renters insurance comes in. State Farm agent Karlie Newton II is passionate about helping you choose the right policy so that you can keep your things safe.

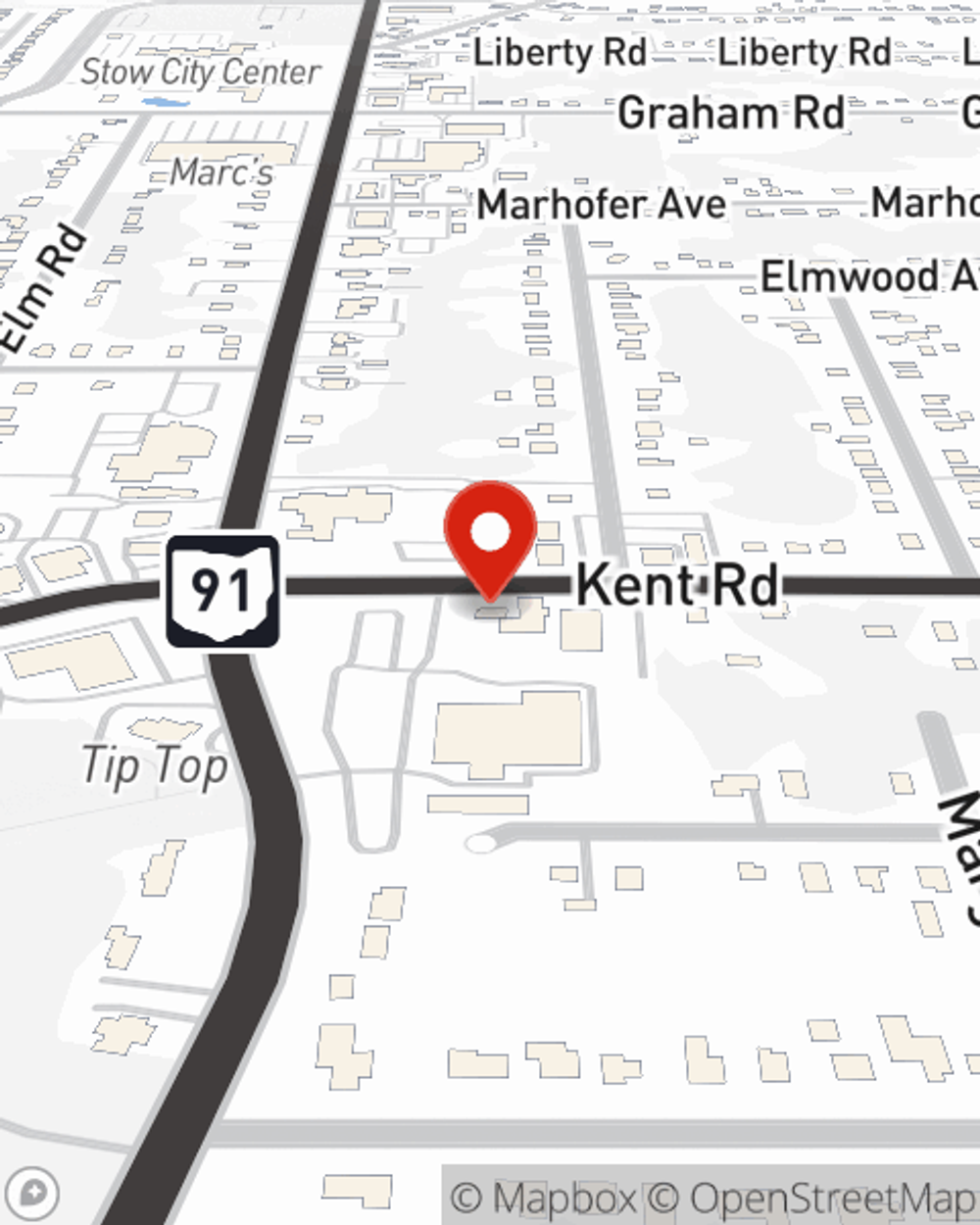

Call or email State Farm Agent Karlie Newton II today to learn more about how the trusted name for renters insurance can protect your possessions here in Stow, OH.

Have More Questions About Renters Insurance?

Call Karlie at (330) 688-9589 or visit our FAQ page.

Simple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.

Karlie Newton II

State Farm® Insurance AgentSimple Insights®

Why should I consider doing home insurance reviews annually?

Why should I consider doing home insurance reviews annually?

You should review your home insurance coverage regularly to ensure you are properly covered. Here are some tips to have a good insurance review.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.